Risk Management

Primacy of Risk Management

Compliance, internal control and risk management are the key components of the company culture which ensures a sustainable growth for our company and are deemed as our company’s competitive edge . Therefore, we always place the highest priority on risk control, eliminating any speculation, fluke or edge ball in the execution.

The concept of risk control:

- Comprehensive risk management is the basic guarantee for the investors’ interests and the development of the company

- Risk cannot be eliminated, but can be managed and controlled

- Every employee should be involved in risk management

The culture of risk control:

- Three lines of safeguards with the participation of all employees

- One-vote veto of compliance and risk control

- No record of significant penalties by the regulator since inception

The Four Pillars of Risk Management

- Three lines of safeguards

- Two meetings

- One platform

- Internal control policy in investment and research process

- Risk control threshold for investment transaction

- Investment and research system

- Transaction system

- Valuation system

- Performance system

- Self-build system

- 6 risk control staff

- 8 compliance staff

- 2 internal auditors

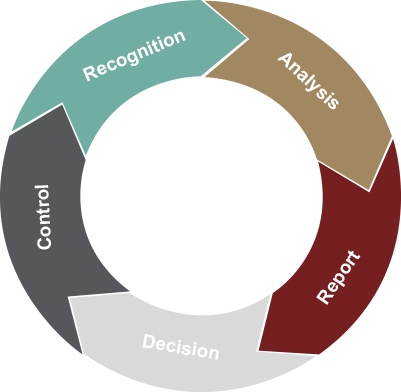

Risk Control Process

-

Risk recognition

Recognize market risk, credit risk, liquidity risk, etc.

-

Risk Analysis

Analyze the risk using qualitative and quantitative methods including stress tests ,internal credit rating system, etc.

-

Regular Reports

All risk reports are sent to investment team, the management and clients regularly for risk assessment

-

Risk Control Decision

The management makes risk control decision according to the risk management opinion

-

Risk Control

Execution of risk control policies

Chinese

中文

Chinese

中文